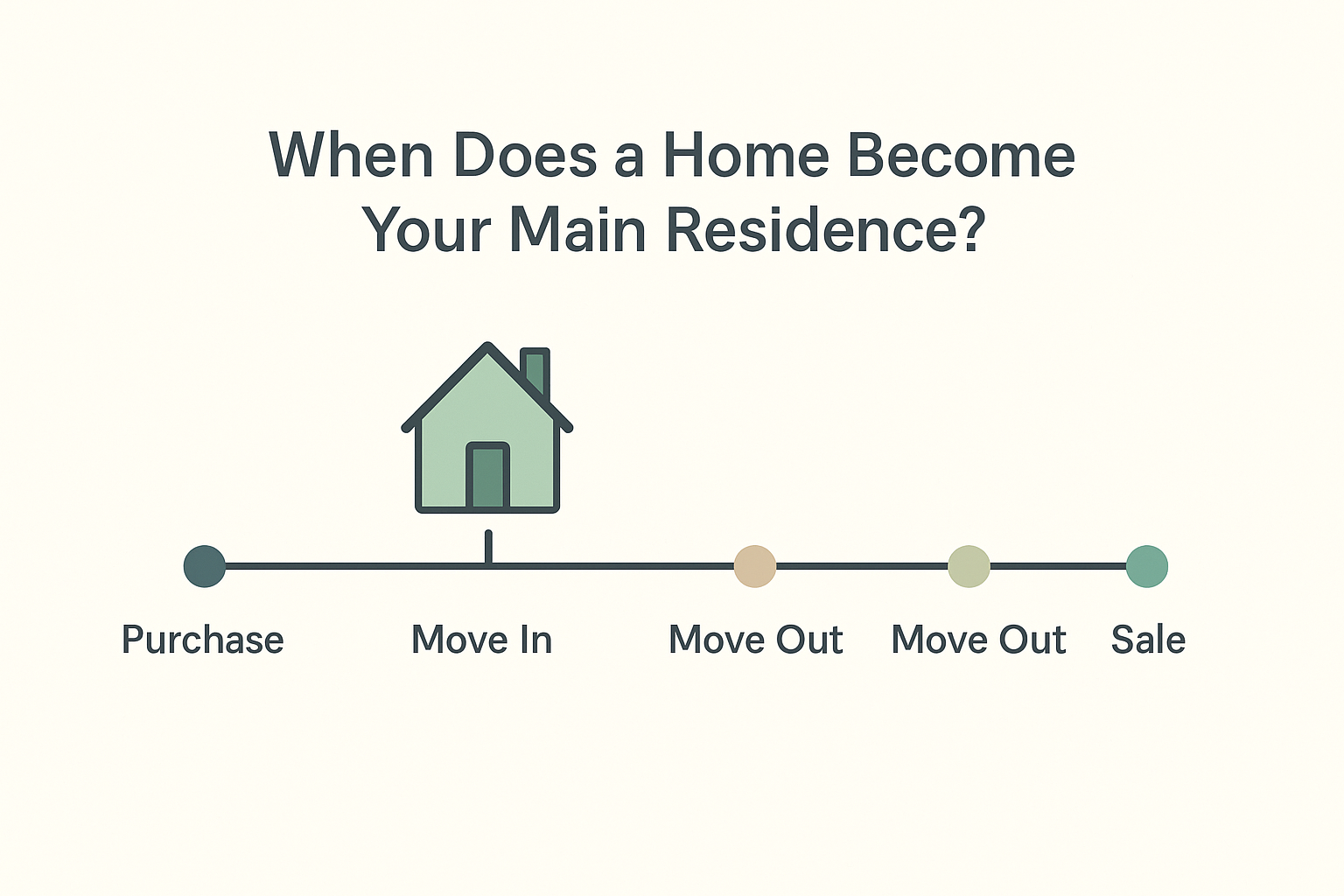

When Does a Home Become Your Main Residence? A Practical Guide for Australian Homeowners

Most people only learn about the “main residence exemption” when they are preparing to sell their home. It usually comes up when their accountant explains that the entire capital gain may not be tax-free. For many homeowners, this is unexpected, because they naturally assume that a property counts as their main residence from the day they bought it.

However, the tax rules look closely at when you actually lived in the home, not simply when you purchased it. Real life does not always line up neatly with the timing required by the tax legislation, especially when you cannot move in straight away, or when family or work changes prompt you to move out and rent the property before selling.

To make this clearer, let us walk through a real scenario and then explain how the rules work.

A Real Story: When Moving In Is Delayed

A friend of mine bought his home on 27 July 2016 and settled on the property on 26 September 2016. He did not move in until 27 February 2017 (154 days after settlement) because he was in a fixed-term rental lease at the time and could not end it early without significant cost.

Several years later, in December 2021, his children changed schools and the drive became too long. He moved out of the home and rented it to tenants. He kept it as an investment property for a few years and sold it on 25 October 2024.

This sequence is common in Australia. People buy a home, move in later than expected, then move out earlier than expected, rent it out for a period, and eventually decide to sell. Nothing unusual. But for tax purposes, the timing of occupancy is what matters most.

The key question is: On what date did the home genuinely become your main residence?

That date determines how much of the capital gain is exempt from tax.

What the ATO Means by “As Soon As Practicable”

For a property to qualify as your main residence from the date of purchase, the ATO requires that you move in “as soon as practicable” after settlement. This phrase sounds flexible, but the tax meaning is specific.

If something unexpected and outside your control prevented you from moving in, the ATO will generally allow the exemption to apply from the acquisition date. Examples include:

• you were unexpectedly sent interstate or overseas for work

• you experienced an illness or medical issue that delayed the move

• the home was genuinely uninhabitable at settlement due to damage

In these cases, the delay is considered unavoidable.

However, if the reason you could not move in was known in advance, the delay is considered a personal choice rather than an unforeseen circumstance. Examples include:

• being tied to an existing rental lease

• purchasing a tenanted property and waiting for tenants to leave

• choosing to rent the property first

In these situations, the home only becomes your main residence from the date you actually move in.

This was the case for my friend. He knew he could not move into the property until his rental lease ended. Because this delay was foreseeable, the exemption could only start from the day he moved in, which is 27 February 2017.

How the Tax Exemption Was Calculated

Here are the figures from his sale:

• Purchase price: $460,000

• Sale price: $680,000

• Capital gain: $220,000

• Total ownership period: 3,012 days

• Days he lived in the property: 2,797 days

Only the 2,797 days he lived in the property qualify for the main residence exemption.

Calculating the exempt portion

$220,000 × (2,797 ÷ 3,012) = $204,296 exempt

Calculating the taxable portion

$220,000 − $204,296 = $15,703 taxable gain

Because he owned the property for more than 12 months, the 50% CGT discount applies: $15,703 ÷ 2 = $7,852 net taxable gain

He is in the top marginal tax bracket (47%), so the tax payable is:

$7,852 × 47% = $3,690

Most people assume all the gain will be exempt. But in cases like this, the exemption only applies from the date you actually moved in.

A Simple Strategy to Reduce the Tax

I suggested that he make a personal deductible super contribution of $7,852, i.e. equal to the amount of taxable gain, before 30 June 2025.

This allowed him to claim a tax deduction equal to the taxable gain and pay tax inside super at 15% instead of paying 47% personally. The tax inside super would be about $1,178, compared to $3,690 if paid personally, a saving of $2,512. This is a straightforward strategy that many homeowners overlook.

Final Thoughts

Many Australians assume that if they lived in a property at any point, the entire gain will be exempt from capital gains tax. But the main residence exemption depends on the timing of when you moved in, how long you lived there, and what happened in the periods before and after occupancy.

In property tax, dates matter.

A clear understanding of these timing rules can prevent unexpected tax outcomes and help you plan ahead with confidence.

No spam, no sharing to third party. Only you and me.

Member discussion