Tax

Salary Sacrifice Car: Is a Tesla "Almost Free"? (The Math Your Friends Aren't Showing You)

Tesla "almost free" via salary sacrifice? Real math shows $64k cost vs $100k in super. Compare novated lease EV vs wealth-building alternative.

Super and SMSF

How to Use Carry-Forward Super Contributions to Catch Up and Save $20,000+ in Tax

High earners can use unused super caps from prior years to catch up on retirement savings. Learn the $500k balance test, Division 293 impact, and strategy.

Super and SMSF

Division 293 Tax Explained: What High-Income Earners Need to Know About Super

For many professionals, superannuation is meant to be the “easy” part of wealth building. Your employer contributes, the tax rate

Tax

Understanding the 6-Year Rule: When Your Home Stays Tax-Free After You Move Out

Most Australians assume the main residence exemption is simple:

“If it is my home, the gain is tax-free.”

But life

Tax

Should You Work Less and Pay Less Tax?

Should You Work Less and Pay Less Tax? A Real Question Many Professionals Are Asking

A few weeks ago, a

Property

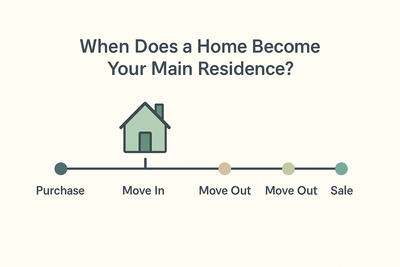

When Does a Home Become Your Main Residence? A Practical Guide for Australian Homeowners

Most people only learn about the “main residence exemption” when they are preparing to sell their home. It usually comes