Salary Sacrifice Car: Is a Tesla "Almost Free"? (The Math Your Friends Aren't Showing You)

A client asked me recently:

"My friends are buying Teslas because they're almost free due to tax concessions. I want to understand how it works. It sounds like a good deal and I was thinking of getting one. I don't really need a car, but Teslas look cool."

This conversation occurs frequently these days. Everyone's heard the pitch: electric cars through salary sacrifice are "basically free" because of the FBT exemption. Free, really?

Let me show you what's actually happening with the numbers and then show you what almost nobody talks about: the opportunity cost.

What Is Salary Sacrifice for a Car (Novated Lease)?

In simple terms, your employer pays for your car from your pre-tax salary, and you get full use of the car. At the end of the lease term (usually 3 to 5 years), you either buy it outright for the residual value, return it, or refinance it under a new novated lease.

A novated lease is essentially buying a car on finance, except your tax benefit makes the car less expensive compared to buying it outside the novated lease arrangement. Does it?

It is not free for sure. How much less the car costs you depends on your marginal tax rate and the term of the lease.

Since electric cars priced up to $91,387 (including GST) are 100% FBT exempt, I'll explain the savings using an electric car to show you the maximum possible benefit.

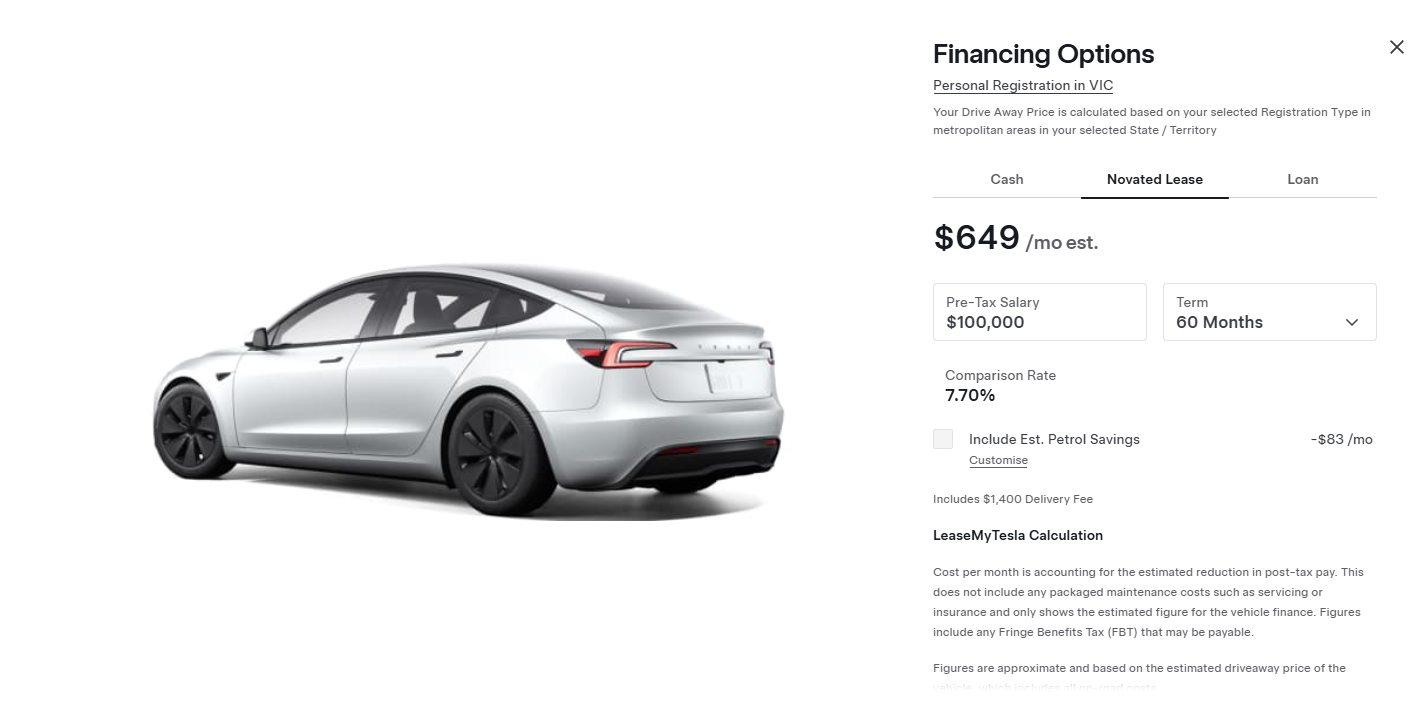

The Real Numbers: Tesla Model 3 via Salary Sacrifice

Let's say a Tesla Model 3 Long Range costs $61,000 (including GST).

Step 1: GST Savings

First, you save GST of approximately $5,000, so the car costs you $56,000 before financing.

Step 2: Financing Costs

The lease term is 5 years at an interest rate of 7.7%. Over 60 months, the car will cost you $77,560 ($56,000 principal plus $21,560 interest).

Step 3: Tax Savings

Now let's say your annual salary is $180,000 and your marginal tax rate is 37%.

Your lease payments over 60 months total $39,000 ($650 x 60 months and excluding residual). At a 37% tax rate, you save approximately $14,430 in tax that you would have paid to the ATO if not for the car lease payments.

Step 4: Final Cost

- Car cost with financing: $77,560

- Less tax savings: -$14,430

- Net cost: $63,130

- Plus GST on residual payment: +$1,700 (Residual payment should be approximately $17,000)

- Total cost to own: $64,830

In five years' time, I'm not sure how much the car will be worth or how easy it will be to sell it.

What If You Return the Car at the End?

If you return the car at the end of the lease term (subject to acceptable condition and mileage), you would have spent $39,000 in lease payments.

With tax savings of $14,430, the car effectively costs you $24,570 to drive for 5 years.

Is this a good option or a smart decision? I don't know. It depends on your circumstances and financial outlook.

But Here's the Question Nobody Asks: Do You Really Need a Car?

My client said: "I'll be paying that $14,430 to the ATO anyway."

I said: "So you want to pay $24,570 instead?"

I don't see the logic in spending money just to save tax.

Let me show you what you could do instead.

The Wealth-Building Alternative: Salary Sacrifice to Super

Scenario 1: If You Were Going to Buy the Car Outright ($64,830)

If I have the capacity to pay $64,830 for a car, leaving aside the fact if I actually need one, here's what I would do instead:

Salary sacrifice $63,130 into super over 5 years:

- Annual contribution: $12,626/year (subject to your concessional cap)

- Tax savings: 22% (37% tax in your pay, but 15% tax paid inside super)

- Annual tax savings (extra cash in your hand): $4,671

- Tax paid inside super (15%): $1,894

- After-tax cash left in super each year: $10,732 ($12,626 - $1,894)

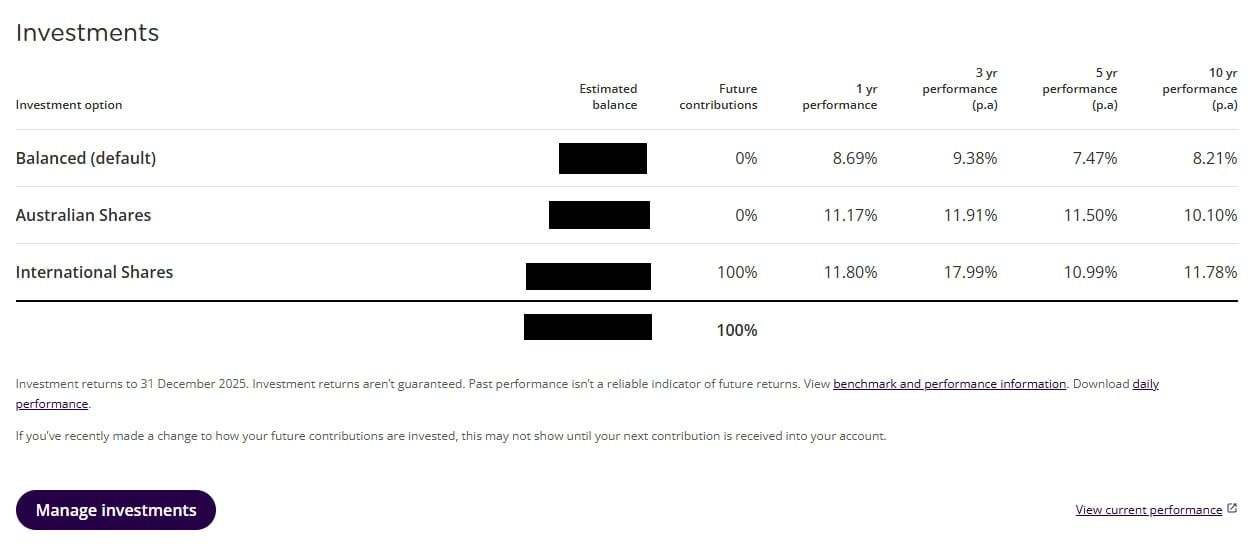

Super balance after 5 years (below is a screenshot from Australiansuper showing 11.8% return - 10-year average):

- Total contributions: $63,130

- Total after-tax investment: $53,660 ($10,732 x 5 years)

- Balance with a growth rate of 11.8% p.a.: $86,654

If you also invest your annual tax savings of $4,671 into super (if you exceed concessional cap, contribute as non-concessional) you'd be well over $120,000 in super balance after 5 years.

Compare this to a Tesla you bought for $63,130 that might be worth $25,000-$35,000 in 5 years

Scenario 2: If You Were Planning to Return the Car

What if you were going to drive the Tesla for 5 years and return it, costing you $24,570 ($7,800/year after tax)?

Using the same approach:

- Annual super contribution: $7,800

- Tax savings: $2,886/year

- After-tax cash in super: $6,630/year

- Total contributions over 5 years: $33,150

Super balance after 5 years (at 11.8% growth) will be $53,532. Compare this to returning a Tesla with $0 left to show for your $24,570

The Real Comparison

Over five years, roughly the same cash outflow gives you:

- A depreciating asset

- Or a growing one

The difference is not tax. The difference is direction.

If You Must Buy a Car: Go Hybrid (on your decision not your car)

If you genuinely need a car, electric is definitely more beneficial than traditional due to the FBT exemption.

But here's a thought I'm leaving you with (same as I left with my client):

What about a hybrid approach?

Instead of spending $64,830 on a Tesla, what if you:

- Bought a BYD or MG4 for $35,000-$40,000 (still FBT exempt)

- Salary sacrificed the remaining $25,000-$30,000 into super

This hybrid financial choice, splitting between a practical EV and wealth building opporunity, might be smarter than going 100% into the car.

The Honest Truth About "Almost Free"

When someone says their Tesla is "almost free," they're usually comparing it to the worst possible option:

- They're comparing it to buying the same car with after-tax cash

- The tax savings make it feel cheaper

- The monthly payment doesn't feel painful

Here's what they're not counting:

- The interest paid to the finance company ($21,560 in our example)

- The opportunity cost (what that money could have become in super)

- The depreciation they're funding

- The residual payment at the end (or having nothing if they return it)

The car is not free. It's just less expensive than the worst way to buy a car (with after-tax cash from your bank account).

A Final Thought on Cars and Wealth Building

I am not saying you should not buy a car. Just think about every dollar you put into a depreciating asset is a dollar that's not building wealth.

This doesn't mean you should never upgrade. It means you should upgrade intentionally.

That Tesla might look great. But in 30 years, when that $64,830 has compounded into nearly $1.5 million in super, you might wish you'd kept driving your old Camry a bit longer.

The question isn't: "Can I afford this car through salary sacrifice?"

The question is: "What am I giving up to drive this car, and is that worth it to me?"

Only you can answer that. But at least now you have the real numbers to make an informed choice.

Disclaimer: This article provides general information only and should not be considered personal financial, tax, or superannuation advice.

Tax rates, marginal tax brackets, FBT exemption thresholds, and superannuation contribution caps are subject to annual change and legislative updates. The calculations shown are illustrative examples based on specific assumptions (including a $180,000 salary, 37% marginal tax rate, 7.7% interest rate, and 11.8% super fund returns) and may not reflect your individual circumstances.

Vehicle prices, specifications, and availability mentioned (including Tesla Model 3, BYD, MG) are examples only and subject to change. Actual novated lease costs vary by provider, vehicle choice, usage patterns, and individual circumstances. Interest rates, residual values, and running costs will differ based on your specific agreement.

The FBT exemption for electric vehicles applies to cars with a first retail price below the luxury car tax threshold for fuel-efficient vehicles ($91,387 for 2025-26) and is subject to eligibility criteria and potential legislative changes.

Superannuation investment returns are not guaranteed and past performance (including historical returns referenced) is not indicative of future performance. Super fund performance varies between funds and investment options.

Before making any decisions about salary sacrifice arrangements, novated leases, superannuation contributions, or vehicle purchases, consult with a qualified financial adviser, accountant, and tax professional who can assess your individual circumstances, financial position, and goals.

About The Wealth Story: We provide plain-English finance advice for Australian professionals on managing money, investments, property, super and SMSF, tax, insurance, and loans and credit.

No spam, no sharing to third party. Only you and me.

Member discussion