Tax

Salary Sacrifice Car: Is a Tesla "Almost Free"? (The Math Your Friends Aren't Showing You)

Tesla "almost free" via salary sacrifice? Real math shows $64k cost vs $100k in super. Compare novated lease EV vs wealth-building alternative.

Insurance

Private Health Insurance vs Medicare Levy Surcharge: Which Costs Less?

High-income earner? Compare the extra tax vs hospital cover premium. Simple framework to decide if private health insurance saves you money.

Super and SMSF

How to Use Carry-Forward Super Contributions to Catch Up and Save $20,000+ in Tax

High earners can use unused super caps from prior years to catch up on retirement savings. Learn the $500k balance test, Division 293 impact, and strategy.

Property

How Naming Your Trust Wrong Can Cost You Thousands in NSW Stamp Duty

What you name your NSW investment property trust can trigger double stamp duty. Learn how to avoid this costly mistake with proper trust documentation.

Property

What Is a Trust (Really)? A Complete Guide for Property Investors in Australia

If you have ever been told "buy the next investment property in a trust", you are not alone.

Property

First Home Super Saver Scheme (FHSS): How to Use Super to Save $50,000 for Your First Home in Australia

Buying your first home in Australia feels increasingly out of reach for many Australians, particularly younger professionals just starting their

Super and SMSF

Buying Property in an SMSF in Australia: A Practical Guide for High-Income Professionals

Over the weekend, I caught up with a friend who is a mortgage broker. He specialises in SMSF lending, which

Super and SMSF

How Super Really Works as a Wealth-Building Tool

Superannuation is often described as something you worry about later in life. Retirement. Old age. A distant future version of

Super and SMSF

Division 293 Tax Explained: What High-Income Earners Need to Know About Super

For many professionals, superannuation is meant to be the “easy” part of wealth building. Your employer contributes, the tax rate

Property

What is a Trust (Really)? A Simple Introduction for Property Investors

Most high-income professionals hear the word “trust” often, but very few understand what it actually means. It appears in conversations

Tax

Understanding the 6-Year Rule: When Your Home Stays Tax-Free After You Move Out

Most Australians assume the main residence exemption is simple:

“If it is my home, the gain is tax-free.”

But life

Super and SMSF

Building Wealth for Your Kids: A Simple Path You Can Start Today

Every wealth story begins somewhere.

For many young Australians, that story starts the day they earn their first pay cheque,

Tax

Should You Work Less and Pay Less Tax?

Should You Work Less and Pay Less Tax? A Real Question Many Professionals Are Asking

A few weeks ago, a

Loans & Credit

APRA’s New Lending Changes: What Australians Need to Know (Starting 1 February 2026)

APRA has confirmed that new rules on high debt-to-income (DTI) home loans will start on 1 February 2026.

These rules

Investing

Why We Cannot Afford Not to Invest

For most of my career, I believed I understood investing better than the average person. I am an accountant, after

Property

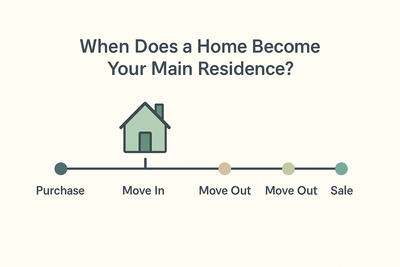

When Does a Home Become Your Main Residence? A Practical Guide for Australian Homeowners

Most people only learn about the “main residence exemption” when they are preparing to sell their home. It usually comes